Home > Investment Guide > Investing Basics

Trading Commodities Versus Currencies

The commodity and currency markets provide traders with an opportunity to generate gains from liquid markets. One of the benefits of trading specific commodities is that you can gauge the specific supply and demand components of these markets, which will provide you with a fundamental picture. Supply and demand are harder to gauge in the currency markets, but a path that describes the future direction of an exchange rate is interest rate differentials.

How to See Supply and Demand

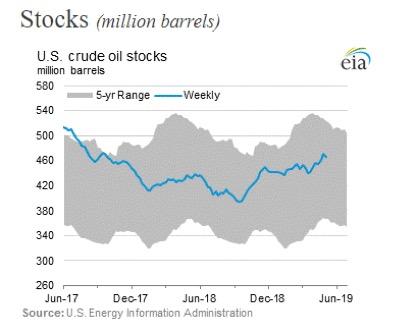

The oil markets are measured based on future supply and demand. One of the best ways to gauge the future sentiment of supply and demand is to have a good picture of current supply and demand figures. The Energy Information Administration provides a weekly estimate of stock piles. The report, which is released every Wednesday, unless there is a holiday on a Monday, describes changes to inventories, as well as production, imports, capacity utilization, and exports. A great chart that is updated weekly shows the volume of oil and product stocks.

You can see over a 2-year period that crude oil stocks held across the US are in the upper quadrans of the 5-year range, but not too far from the middle of the 5-year average range. When stocks are hovering near the upper end, prices should be under pressure. When stockpiles are in the lower end of the 5-year range, prices should be buoyed.

What you need to remember is that traders are attempting to gauge future inventories. Which means that today’s inventories are only a guide to what future inventories. Analysts will estimate inventories, and based on the trajectory of inventories, you can determine if you believe the price has incorporated those assumptions.

Measuring Currency Demand

There is a way to determine supply and demand in the currency markets. The clue is in the forward market. It would be the same if you want to trade gold. Just like the oil market traders are attempting to determine the supply and demand for money in the future. The forex foreward market incorporates those assumptions.

The forward market is made up of interest rate differentials. This is the difference between one country’s interest rates and another country’s interest rates. The interest rate that is measured is based on how long you plan to hold your position. The forward rate can extend for 30-years, but most consider periods of 2-years or less as the forward market. The direction of the forward market is based on the interest rate differentials. For example, the EUR/USD forward market is the current spot market plus the forward points. The forward points are calculated by converting the forward differential into a rate added or subtracted from the spot rate.

The forward rate is driven by expectations that one countries interest rates will rise relative to another country. This is based on expectations that interest rates will rise or fall in both countries. Once you have a view of future rate changes you can derive a supply and demand model. Demand is created when one country’s interest rates rise relative to another.

More to Read:

Previous Posts: